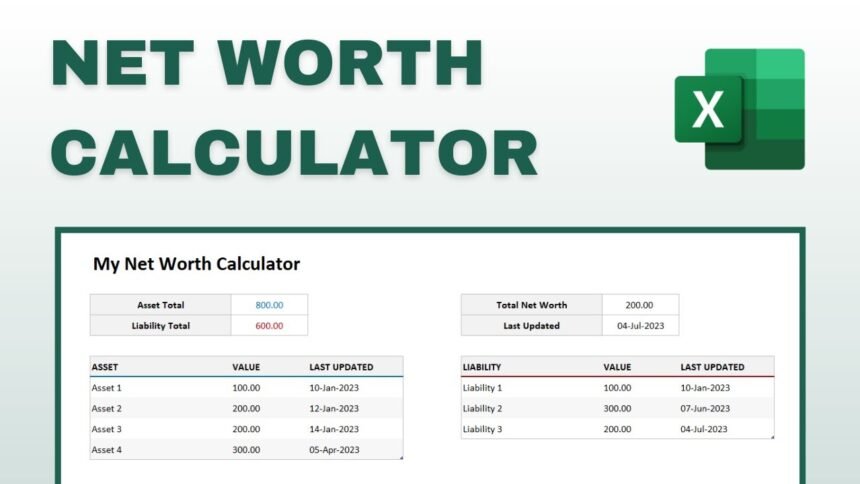

A net worth calculator is a valuable tool for tracking your financial progress. It helps you calculate the difference between what you own and what you owe, giving you a clear snapshot of your financial standing. Whether you’re managing personal finances or planning long-term goals, knowing your net worth can guide better decisions.

Understanding Assets, Liabilities, and How to Calculate Your Net Worth

If you’re looking to get a better handle on your finances, one of the first things you should understand is your net worth. It’s a simple concept, but it can make a huge difference in how you plan for the future. To help you get started, let’s break down the key terms: assets, liabilities, and net worth.

What Are Assets?

At its core, assets are things that have value and that you own. Think of assets as anything that puts money in your pocket or can be sold for cash if needed. This can include:

- Cash: The money you have in your bank accounts or in hand.

- Investments and Retirement Accounts: Your 401(k), IRAs, or any other investment accounts.

- Vehicles: Cars, motorcycles, or anything else of value that you own.

- Real Estate: Your home or other property you own.

Essentially, assets are the things that help build your wealth over time.

What Are Liabilities?

On the flip side, liabilities are the debts you owe. These can drain your financial resources and prevent you from growing your wealth. Common liabilities include:

- Credit Card Debt: The outstanding balances on your cards.

- Student Loans: Any educational loans you’re still paying off.

- Mortgages: The balance remaining on your home loan.

- Auto Loans: The remaining balance on any vehicles you’ve financed.

The more liabilities you have, the lower your net worth will be, so it’s important to manage and reduce these debts whenever possible.

How to Calculate Your Net Worth

Now that you understand assets and liabilities, calculating your net worth is pretty straightforward. Here’s how it works:

- List Your Assets: Add up everything you own that has value. This includes your cash, retirement accounts, vehicles, real estate, and any other valuable items you could sell for money.

- List Your Liabilities: Next, write down what you owe, like credit card debt, student loans, mortgages, auto loans, or anything else you still have to pay off.

- Subtract Liabilities from Assets: To calculate your net worth, simply subtract your total liabilities from your total assets. The result is your net worth.

If you have more assets than liabilities, congratulations—you’re building wealth! If not, don’t worry—this is a snapshot of your current financial situation, and with some planning, you can improve it over time.

Can Something Be Both an Asset and a Liability?

You might be wondering, “Can something be both an asset and a liability?” And the answer is yes, it can!

Take your home or car, for example. These are assets because they have value and could be sold for cash. However, they’re also liabilities because you likely owe money on them—like a mortgage or car loan. The part of the house or car that you still owe on is a liability, while the portion you’ve already paid off is your asset.

It’s important to recognize both sides because understanding this duality helps you manage your finances more effectively. Over time, as you pay off the debt associated with these items, they’ll become stronger assets in your financial portfolio.

Wrapping Up

Understanding your assets, liabilities, and net worth is a critical first step in achieving financial success. By calculating your net worth regularly, you can keep track of your progress, identify areas for improvement, and set goals for the future. The goal is simple: Build more assets, reduce your liabilities, and increase your net worth!

Conclusion

A net worth calculator is a great tool to check how much money you really have. It helps you see what you own and what you owe, making it easier to plan for your future. By using this calculator, you can save smarter, pay off debt faster, and feel more confident about your money.

Tracking your net worth regularly helps you see your progress. Even small changes, like saving more or paying down a loan, can make a big difference. Start using a net worth calculator today and take the first step toward a better financial future!

FAQs

Q: What is a net worth calculator?

A: A net worth calculator is a tool that shows how much money you have after subtracting your debts from your assets.

Q: Why should I use a net worth calculator?

A: It helps you understand your financial health and plan for future savings and spending.

Q: What do I need to use a net worth calculator?

A: You need to list your assets (like savings, property, or investments) and your debts (like loans or credit cards).

Q: Can a net worth calculator help me save money?

A: Yes! It shows where you stand financially so you can create a better savings plan.

Q: How often should I check my net worth?

A: It’s good to check your net worth every few months or at least once a year to track your progress.